West London Office News (Keely Hodgkinson 800m final, celebrating her gold medal – above)

SOMETHING TO CELEBRATE 2024 PARIS OLYMPICS

Welcome to the Q2 update of 2024, with an up-to-date view of the commercial property market in West London Office News. Featured in this issue: Market Summary, Take-Up, Q2 Headlines, and Hammersmith Office Market, What is next for a change of use?

OVERVIEW Q2 – West London Office News

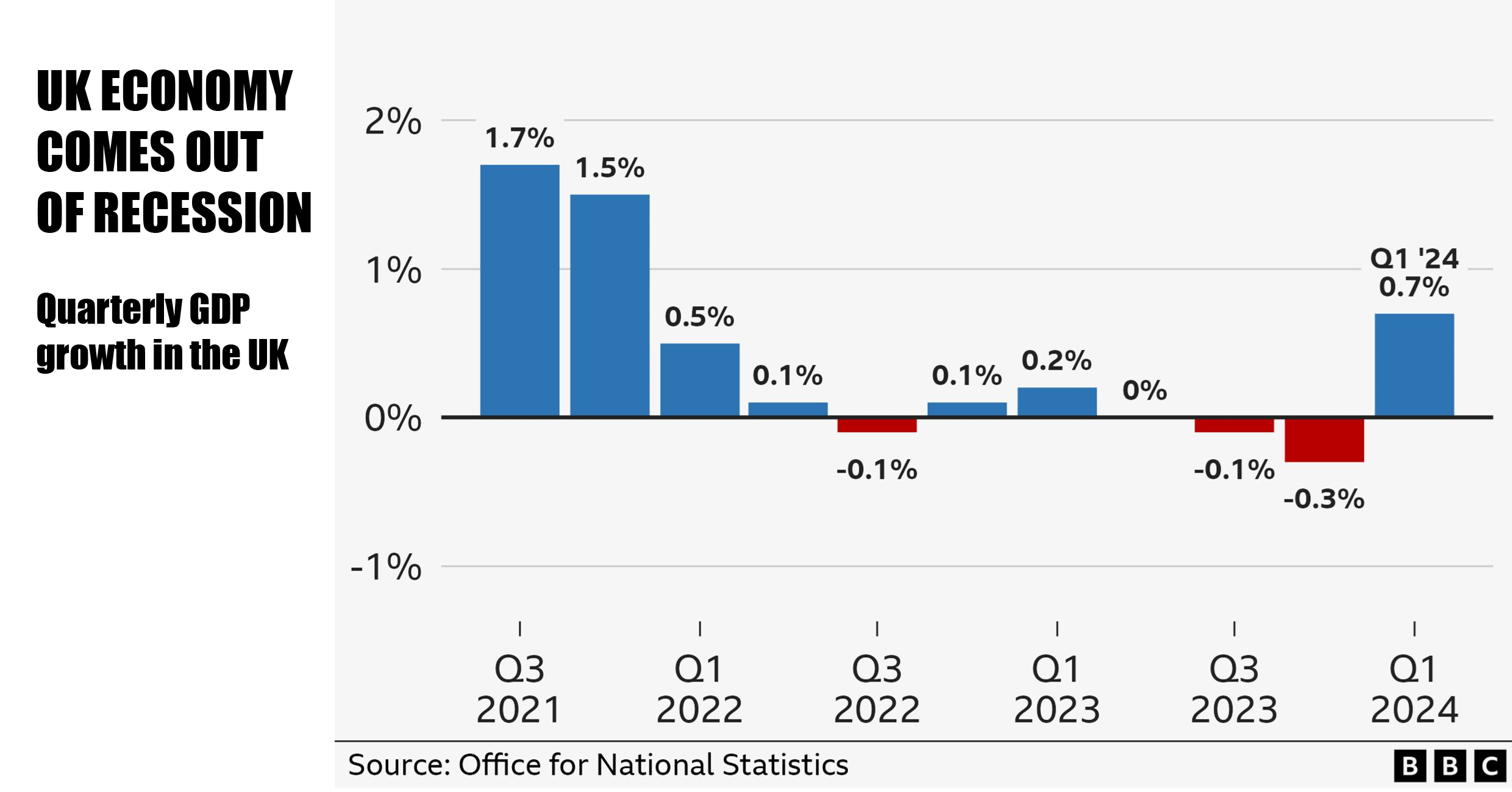

There are positive signs for the UK economy in Q2 this year with growth of 0.6% and stabilising interest rates setting a more optimistic outlook for the office market.

Interestingly, the ONS reported that growth was led by the services sector, particularly the IT industry, legal services and scientific research, which grew by 0.8% in the quarter with widespread growth across the sector.

This bodes well for the office occupational market but the stark reality of the lag in this potential demand is shown by the take-up stats for west London highlighting another slow quarter with considerably below average level of leasing activity.

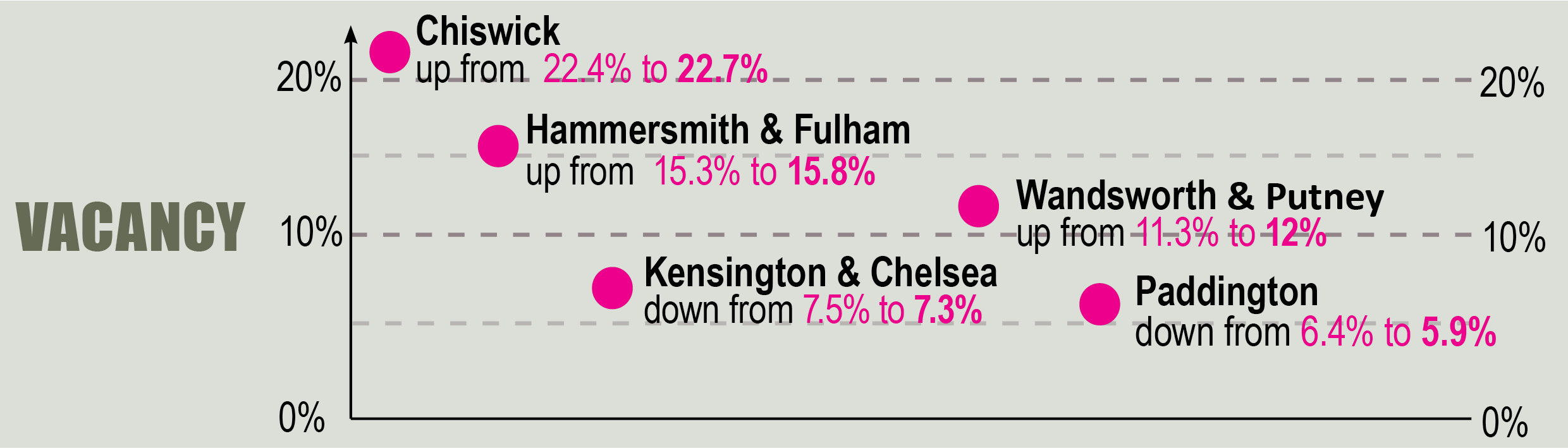

In Hammersmith & Fulham, just 45,000 sq ft was signed in the quarter representing 13 deals, the largest being 14,000 sq ft in White City. Vacancy levels across the west London markets have remained generally unchanged.

BAYSWATER

In Bayswater, Get the Guests, a film production company, agreed on 1,600 sq ft at 6 Salem Road W2 for £60.50 sq ft for a 1-year term.

KENSINGTON & CHELSEA

In Kensington Ashby Capital let 4,273 sq ft on the 4th floor at The Kensington Building to VR Advisory Services, and service provider Ferrari Group took 3,735 sq ft at quoting rent c.£80-£100. At the Universal Building, Angela Hamlin the private care and nursing provider took 3,300 sq ft at £38 per sq ft for 5 years.

In Chelsea 60 Sloane Avenue, Arrow Ship Broking Group completed on 22,641 sq ft quoting rent £115 per sq ft.

HAMMERSMITH & FULHAM

In Hammersmith Sumitomo Chemical (UK) PLC took 2,629 sq ft in Space One, Beadon Road W6 at £49.50 per sq ft for 10 years (Landlord Romulus). AC Fashion Design a personalised gifts & clothing company, agreed on 5,195 sq ft at Colet Court, 100 Hammersmith Road W6 for £25 per sq ft for 5 years (Landlord London & Regional).

At Clockwork Building in the Ravenscourt Park area, Red Valley Ltd, a digital marketing company took 3,547 sq ft at £42.50 per sq ft for 10 years (Landlord CLS Clockwork Ltd). Furukawa Electric Ltd are moving from Farriers Yard and taking 3,381 sq ft at Colet Court.

CHISWICK & ACTON

In Acton, Frost Meadowcroft’s client Vision Develop completed on the sale of Roslin Road & Sterling Road totaling 26,695 sq ft for £6.825 million to a private purchaser.

In Chiswick, Halliburton, the oil company, signed at the Chiswick Building taking 5,126 sq ft at £47 per sq ft for 5 years (Landlord: Schroders). At Power Road Studios, JSS Recruitment agreed on 543 sq ft for 3 years.

Chiswick Park has seen a flurry of lettings in Q2. Building 12 has been let to Sega the games company and makers of Sonic Hedgehog who have taken 20,614 sq ft on the 3rd floor. At Building 4 Micro Strategy, the AI data tech company, agreed on 3,494 sq ft at £52.50 per sq ft for 5 years. Also in Building 4, Dell agreed on 14,740 sq ft on the 4th floor for £53 per sq ft for 10 years.

Read more in Headlines…

WHITE CITY & NOTTING HILL

In White City at Gateway Central, the biggest deal was to Dogmates Ltd, known as ‘Butternut Box’ the fresh dog food providers, who have taken 14,045 sq ft.

In Notting Hill Oliver Fisher Solicitors agreed at 87 Lancaster Road for 3,291 sq ft at a rent of £40 per sq ft for 7 years (Landlord: Adena Property represented by Frost Meadowcroft).

West London Office News – Market Update Q2 2024 – Frost Meadowcroft

Recent data for Q2 on office space in Hammersmith reveals that the market is still in recovery mode following the disruptions of 2020 and 2021.

With a high supply of office space accounting for 15-20% of the built stock in West London lower grade buildings are struggling to attract occupiers. Decreasing rents and vacancies are leading to lower capital values and the cost to refurbish these offices to meet the necessary EPC and ESG standards is often not economically viable. So, what’s next for these properties?

Declining capital values have caught the attention of developers, making the conversion of office spaces to residential use viable again. If a building can be bought for £250 – £300 per sq ft in an area where flats sell for £750 – £1,000 per sq ft, it makes financial sense to consider this change, pending planning approval. This is where it gets interesting: with no Article 4 direction (protecting employment use) currently in place for the town centre, several former high-profile offices in Hammersmith are being acquired with the intention of changing their use through permitted development or specific planning applications.

Notable properties like Chivas House (35,000 sq ft) on the River, Grove House on Hammersmith Grove (65,000 sq ft), Hythe House on Shepherds Bush Road (58,000 sq ft), Lyric House on Hammersmith Road (25,000 sq ft), and Farriers Yard & Forge on Fulham Palace Road (55,000 sq ft) are all under consideration and the outcome of these applications is highly anticipated.

The central Hammersmith commercial hub has seen development and refurbishment of several impressive new office spaces, such as The Ark and 245 Hammersmith Road, this ensures that the market remains well supplied with lettable Grade A space.

Local authorities need to recognise that change of use, under certain circumstances, can be beneficial. Older, obsolete buildings should be considered for alternative uses if these properties are to have a future, they must evolve.

Farriers Yard & Forge, the office buildings mentioned above, are being marketed for sale by Frost Meadowcroft and CBRE. These 55,000 sq ft buildings are part of the larger 250,000 sq ft Assembly development, which was purchased by private overseas clients of Knight Frank Investment Management earlier this year. While The Foundry, a grade A office building within the development, is currently commanding rents of around £50 per sq ft, Farriers Yard stands as an example of an older office space that would be uneconomical to refurbish for continued office use. Given its condition and market dynamics, Farriers Yard & Forge are considered more suitable for conversion to a different use, with current interest coming primarily from residential developers. The properties are being offered at a guide price of £15 million.

Developer Vabel has completed on the acquisition of 114-150 Queensway & 97-113 Inverness Terrace opposite The Whiteley for an undisclosed sum. The site already has consent for 87,000 sq ft of offices, 30,000 sq ft of residential and 23,000 sq ft of retail space but Vabel intends to submit new proposals.

2024 has been a successful year at Chiswick Park with more than 135,000 sq ft of transactions in Q1 & Q2. Lettings include approximately 21,000 sq ft to Sega in Building 12 and 15,000 sq ft to Dell in Building 4, who recently sold their Thames Valley, Bracknell head office.

Pokemon, represented by Frost Meadowcroft have just completed on a total of around 60,000 sq ft in Building 10.