Market Update Q1 2015, welcome to the first update of 2015, giving you an up-to-date view of the office, investment & development market in the west of the West End and providing an insight into prevailing trends in this sector.

Q1 MARKET SUMMARY Market Update Q1 2015

Bear Grylls

Office demand continued into Q1 with increasing take up further reducing supply to record lows leading to increased rents. Residential transaction levels are lower possibly due to the political uncertainty of the General Election on May 7th. Reduced affordable housing seems likely given the Government has introduced Vacant Building Credits (see below). Best rents in Hammersmith and Kensington & Chelsea are at £50 with Chiswick and Fulham at £45 per sq ft. Shine TV, Elisabeth Murdoch’s TV company which makes Bear Grylls, relocated to Helical Bar’s Shepherds Studios in Rockley Road, Shepherds Bush where they join the rest of the Endemol Shine Group. They paid a new record rent of £47.50 per ft for the 13,000 sq ft, 3rd floor. Capital values of commercial investment property have also increased as continued low interest rates and lower cost of borrowing have reduced yields. Grade A investment property let for 10 years is down to 4 to 6 per cent locally as prime central London yields reduce to below 4 per cent. Aviva, in particular, look set to substantially increase their portfolio in the London Borough of Hammersmith and Fulham. It has been reported that they are under offer on the purchase of a 100,000 sq ft section of the 1st phase of the BBC TV Centre (see detail below) as well as under offer on the 12 floor, 187,405 sq ft Translation Building just north of BBC TV Centre on Imperial’s new campus. The Translation Building will be situated just north of the A40 Westway on the BBC’s former Woodlands site. The forward funding of this development is reported to be £150m (£800 per sq ft) a yield of 3.5% for the 25 year lease to Imperial at £29.30 per sq ft. The Translation Building is due for completion in April 2016

The first phase of the redevelopment of Television Centre in Wood Lane, White City, W12 is under offer for over £60m (£600 per sq ft) to Aviva. The commercial arm of the BBC have signed a 25 year lease at £26.50 per sq ft for the 100,000 sq ft building called Stage 6. The developer Stanhope has sold it for a net initial yield of 4%.

GOVERNMENT ABANDONS OFFICES TO RESIDENTIAL PERMISSION

Permitted Development (PD) which allows offices to be converted to private residential was set to expire in 30th May 2016. The change was originally introduced for a three-year period but Whitehall last year proposed to make it permanent. However, it has now dropped this idea, as revealed by an explanatory memo released by the Government last week. Responses to a government consultation carried out last year had raised “concern on the future availability of business premises, the impact on surrounding businesses and the quality of the new dwellings”, according to the memo. In our last update we reported that generally, Central Government appeared pro PD to improve housing supply whereas Local Authorities (particularly zone 2 to 6 London Authorities) were generally against it because of the loss of employment and lack of control over the process). Shadow Housing Minister Emma Reynolds, said the office-to-residential policy was having “very deep unintended consequences”. She pointed to Croydon as an example of an area seeing “swathes” of business space turned into homes. Further concerns were expressed by Boris Johnson who warned that making it easier to convert offices to homes “threatens the future of the City”. The Government’s high street champion Mary Portas and business leaders also lined up against the measure, arguing that clusters of creative and design businesses in particular were being damaged.

HERMES BUYING OLD WIMPEY HQ

The former George Wimpey HQ at 26-28 Hammersmith Grove is being sold as an investment for over £118m (£577 per sq ft) and at a net initial yield of 4.74% The 204,561 sq ft multi-let office building is at the southern end of the tree-lined Avenue. It has a comparatively low average passing rent (£28 per sq ft) in comparison to prime Grade A Hammersmith rents hence the sub 5% yield. The vendors, Tyburn Lane, bought it in April 2006 for £74m.

VACANT BUILDING CREDITS TO REMOVE AFFORDABLE HOUSING

On the 28th November 2014, the Government added additional text to the National Planning Practice Guidance, the purpose of which, was to incentivise brownfield development and bring back vacant buildings into lawful use. This means where a vacant building is brought back into any lawful use, or is demolished to be replaced by a new building, the developer should be offered a financial credit equivalent to the existing gross floor space of relevant vacant buildings when the local planning authority calculates any affordable housing contribution which will be sought. Affordable housing contributions would only therefore be required for any increase in floor space unless the new building to be constructed is the same size as the existing building on the site. It will be interesting to see this new guidance tested in the planning process this year.

LANDMARK HOUSE & THAMES TOWER SOLD for £57m

Dubai based educational establishment Gems have now sold Landmark House and Thames Tower to a Maylasian Developer Eastern & Oriental, having abandoned hope of establishing a school on the 1.2 acre central Hammersmith site. Gems bought the 1975 constructed Landmark House & Thames Tower overlooking St Paul’s Church and Hammersmith Flyover in Q4 2011 for £34m. Gaining from the rising market of 2013 and 2014 they have now sold the property to the Malaysian developer for £57 million (£420 per sq ft). The developer has said that subject to planning approval there is the potential to create Grade A office space and residential accommodation.

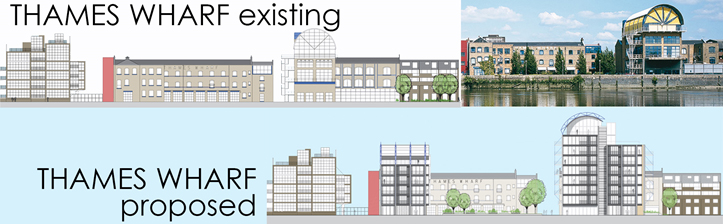

THAMES WHARF

London & Regional Properties has submitted a planning application for a residential led redevelopment of Thames Wharf by the River in Hammersmith. The Hammersmith site is being redeveloped after the departure of architects Rogers Stirk Harbour and Partners, who relocated to the Leadenhall Building, nicknamed the Cheesegrater (as mentioned in Q4 Market Update). They are seeking approval to demolish the existing buildings adjacent to the River Thames and build two new residential blocks with balconies which will be six to nine storeys high together with the retention and conversion of the buildings fronting Rainville Road. The development will provide a total of 57 residential units (Class C3); 7,524 sq ft ground floor office space (Class B1); 1,249 sq ft flexible restaurant/office space (Class B1/A3), retention of a 5,856 sq restaurant (Class A3) new access arrangements, basement car parking and cycle parking. The Michelin starred River Cafe, which is owned and run by Lord Rogers’ wife Ruth, will have the option to renew its current lease when it runs out at the end of next year and the planning application indicates that the River Cafe will remain on the redeveloped site. Thames Wharf Studios was once Duckham’s oil facility. By the late 1960s Duckham had become the largest selling brand of motor oil in the country. The company was bought by BP in 1970, and the works at Thames Wharf were closed in 1979 being converted into offices by Richard Rogers in 1983.

DOWNLOAD TO READ IN FULL